Have a listen.

Like what you hear and never want to miss an episode? Sign up to our mailing list and be the first to hear our latest news and announcements.

- Season 3

- Season 2

- Season 1

Episode 32

That Mint Finale

Episode 31

Inflation, working culture and a mid-life crisis

Episode 30

The inevitability of death (and taxes)

Episode 29

Tech a chance on me

Episode 28

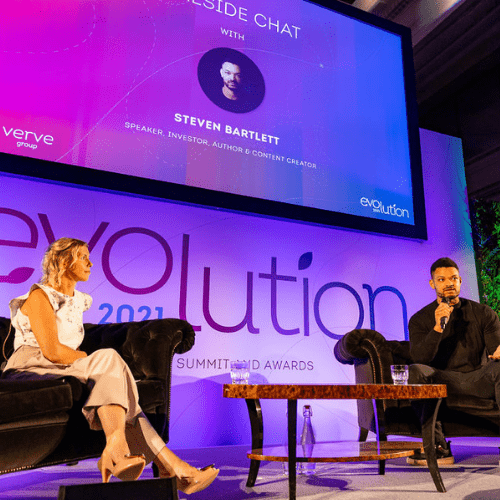

When Cathi met Steven

EPISODE 27

What are you saving for?

EPISODE 26

Living longer, mortgages and NFTs

Episode 25

What does inflation IRL mean for me?

EPISODE 24

That Mint Live Episode

Episode 23

Influencers and advertising standards

Episode 22

Insurance - do I need it?

Episode 21

Bad money decisions

EPISODE 20

Happy New Tax Year!

Episode 19

#SideHustle

Episode 18

Pension Case Study - Decade by Decade

Episode 17

Pensions - do I need one?

Episode 16

That Mint Christmas Special

Episode 15

What are interest rates?

Episode 14

That Mint Afterparty

Episode 13

Highlights - TMP So Far 2020

Episode 12

Buying & Selling Houses

Episode 11

Busting financial jargon

Episode 10

Coronavirus: With a slice of lime

Episode 9

Going halves on a baby

Episode 8

What can I do with my cash?

BONUS #2

Meaningful Money in Conversation

Episode 7

Do I really need savings?

Bonus #1

What can I do with my cash?

Episode 6

Coronavirus Special

Episode 5

Sweet FAs

Episode 4

How much does it cost to die?

Episode 3

Am I better off dead - what is life insurance?

Episode 2

Can I retire at 30? (Part 2)